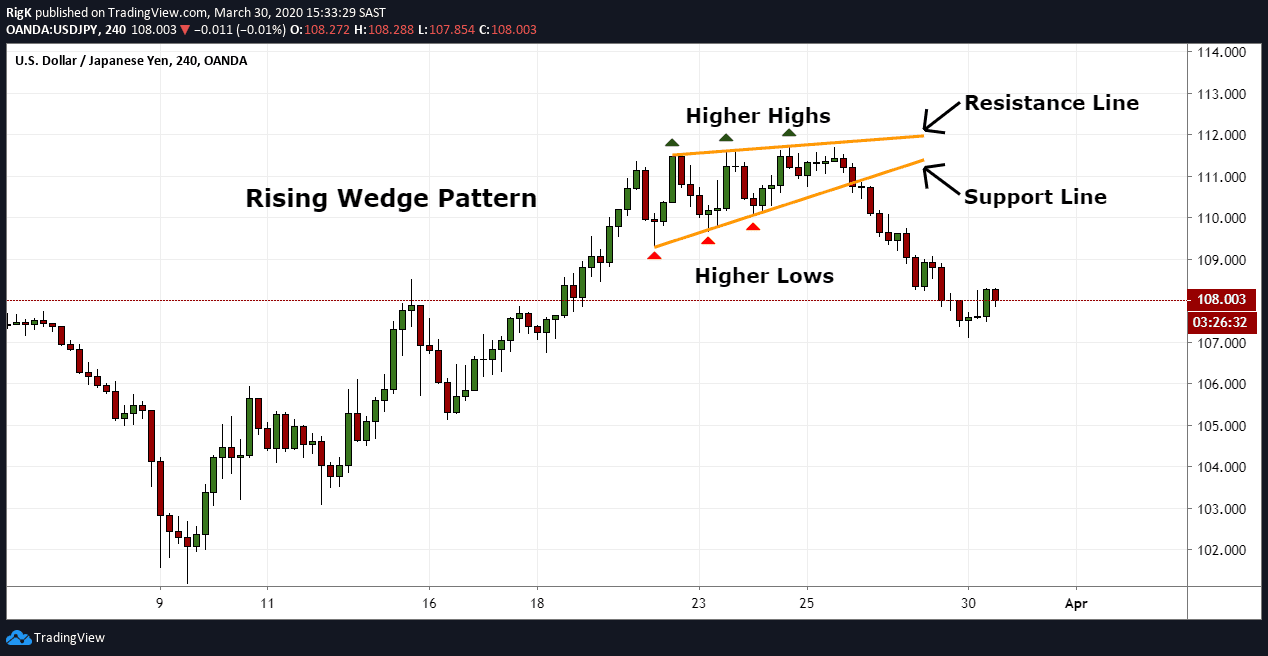

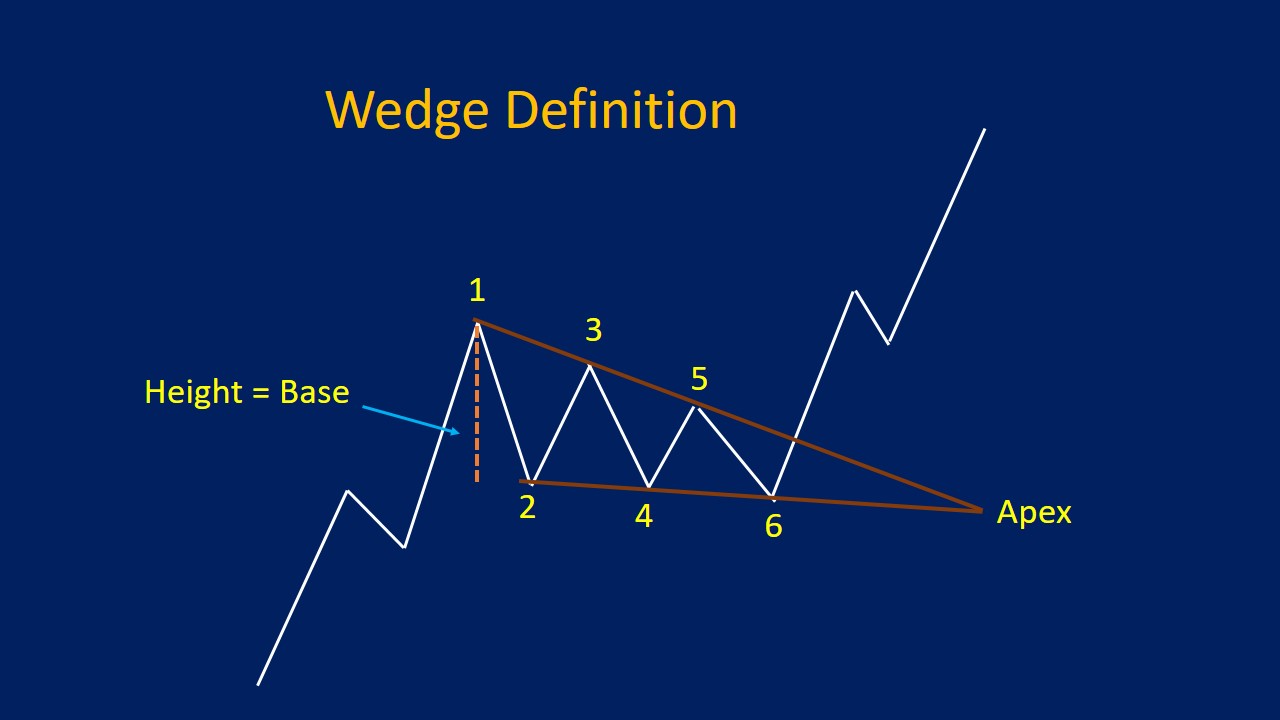

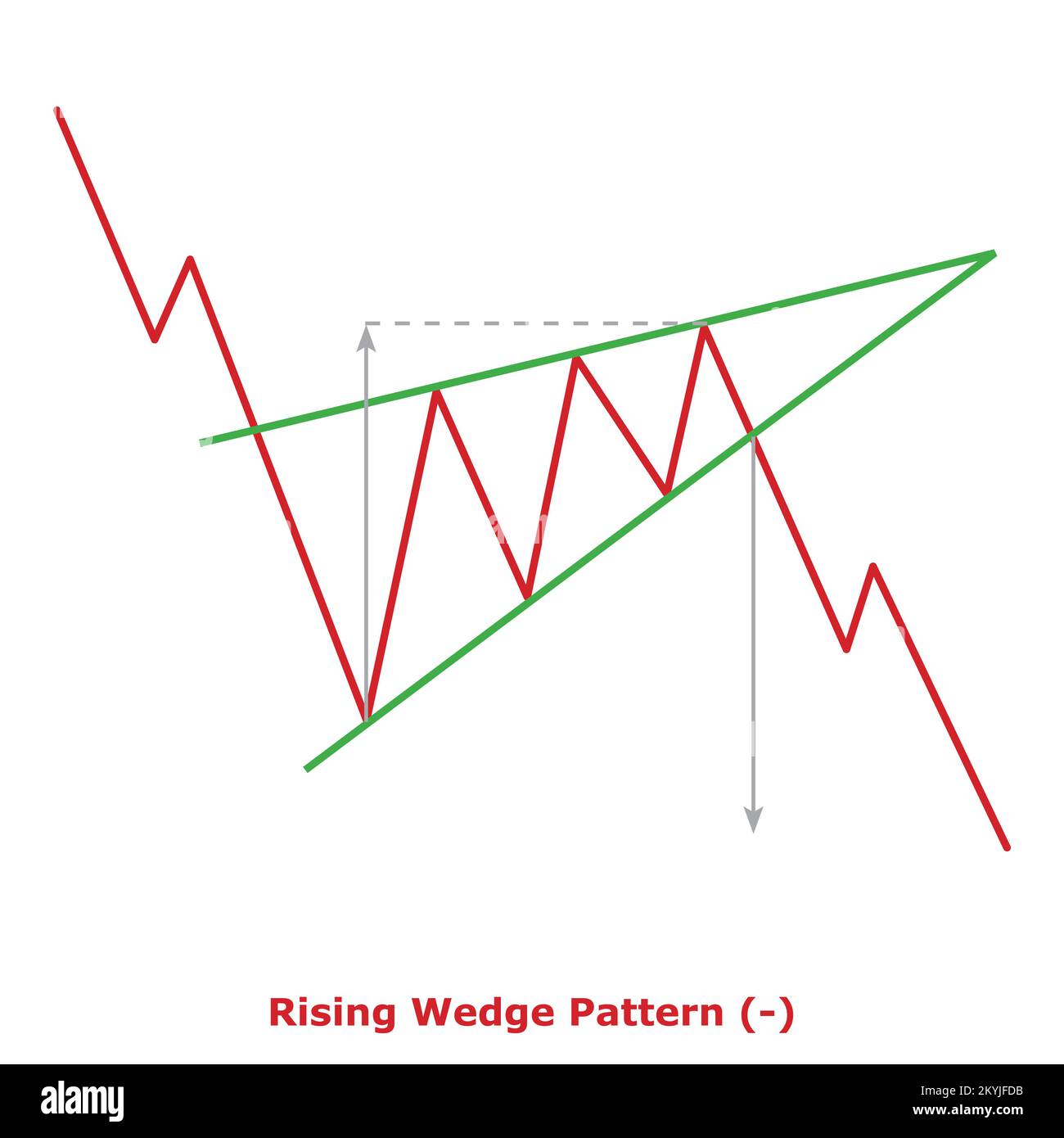

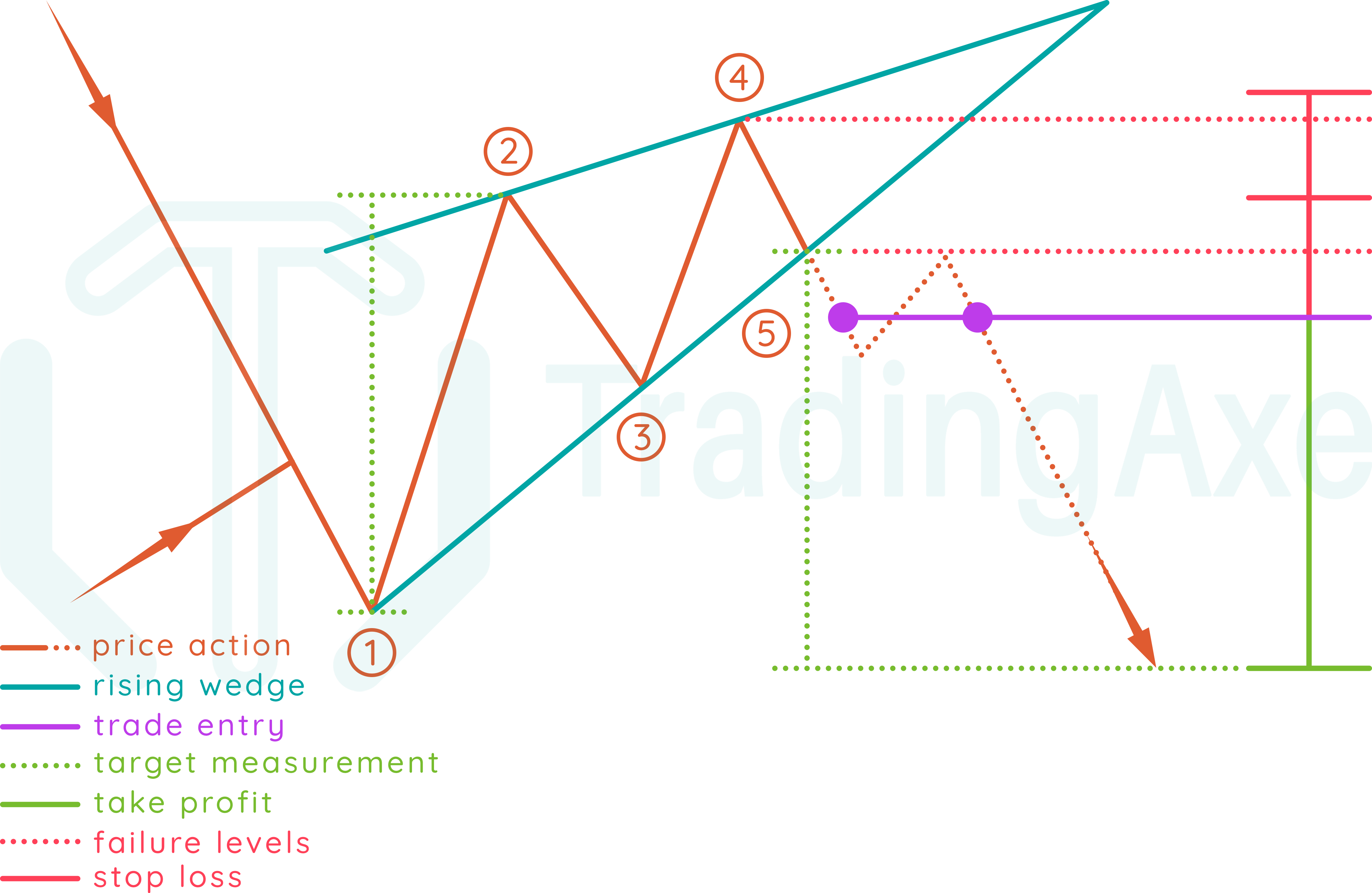

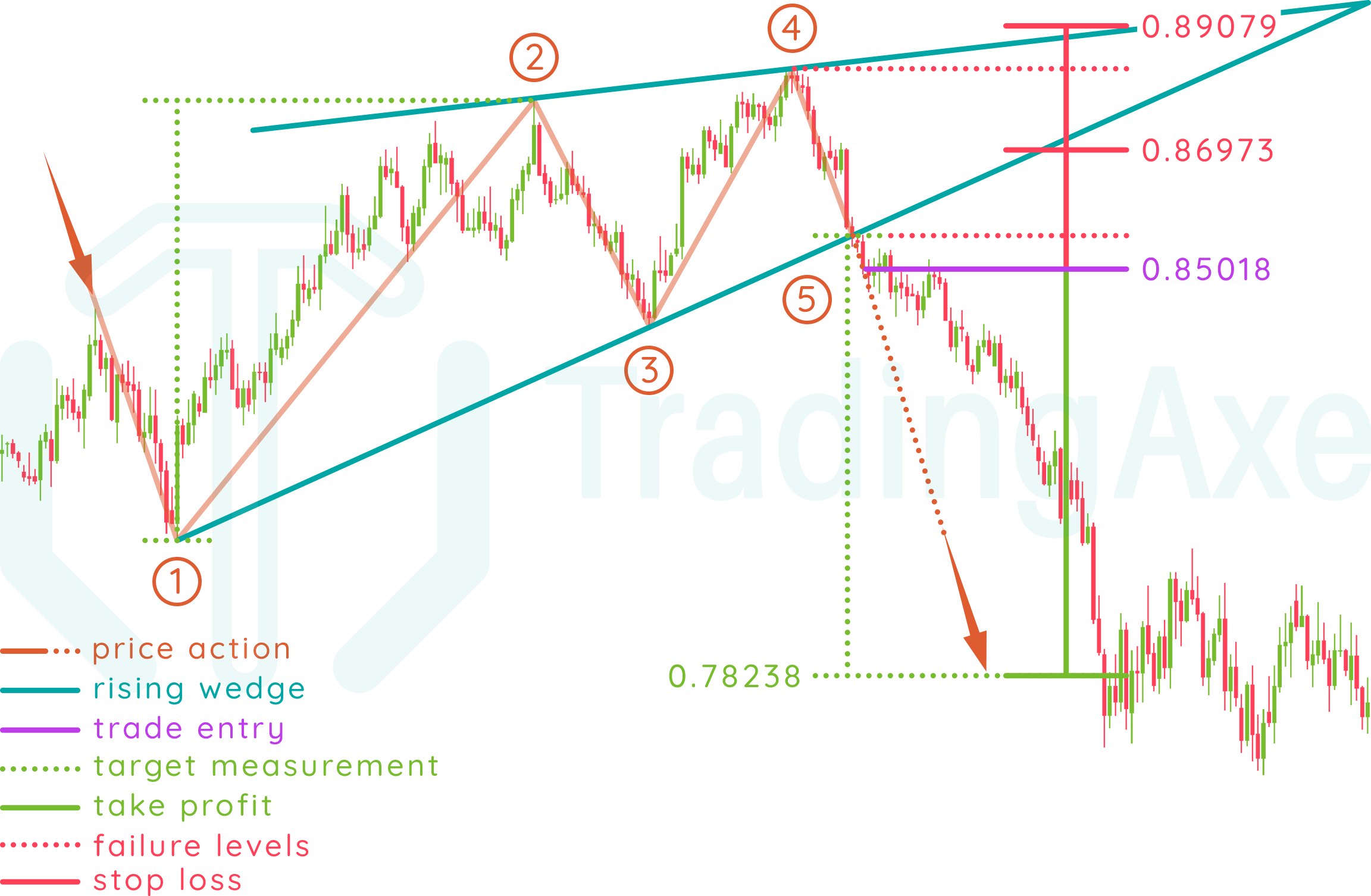

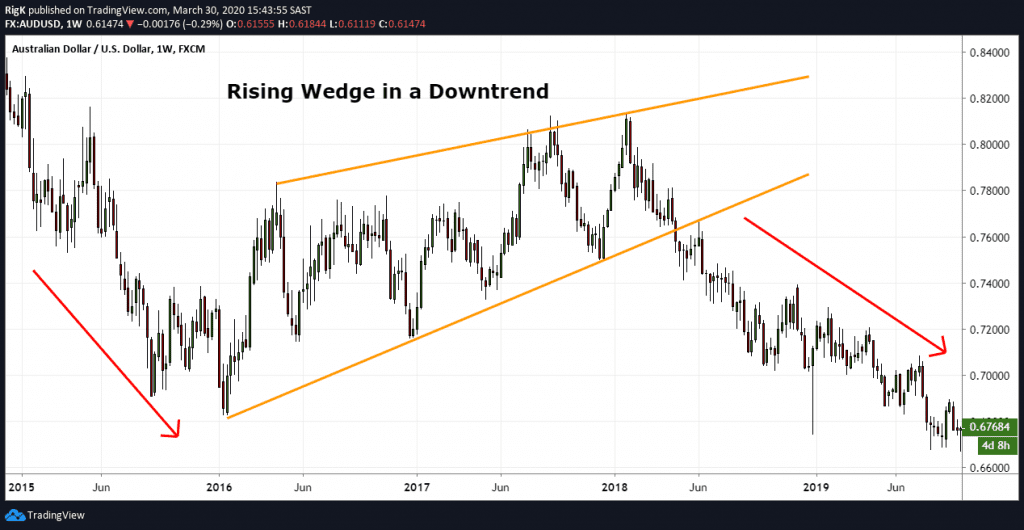

chart pattern rising wedge. Wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. At first, the stock seems to be going up and buyers are in.

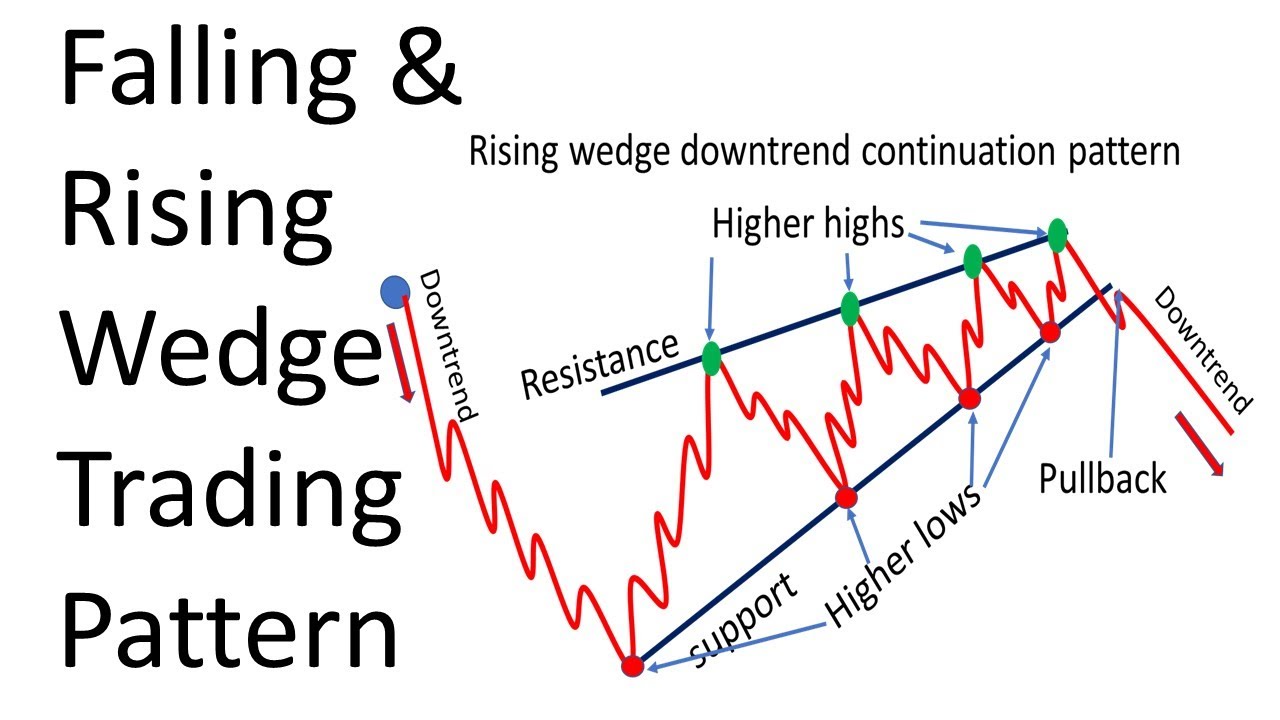

chart pattern rising wedge A rising wedge pattern is formed by two converging trend lines. The rising wedge pattern is used in financial markets to identify potential trend reversals. Rising wedge patterns indicate the.

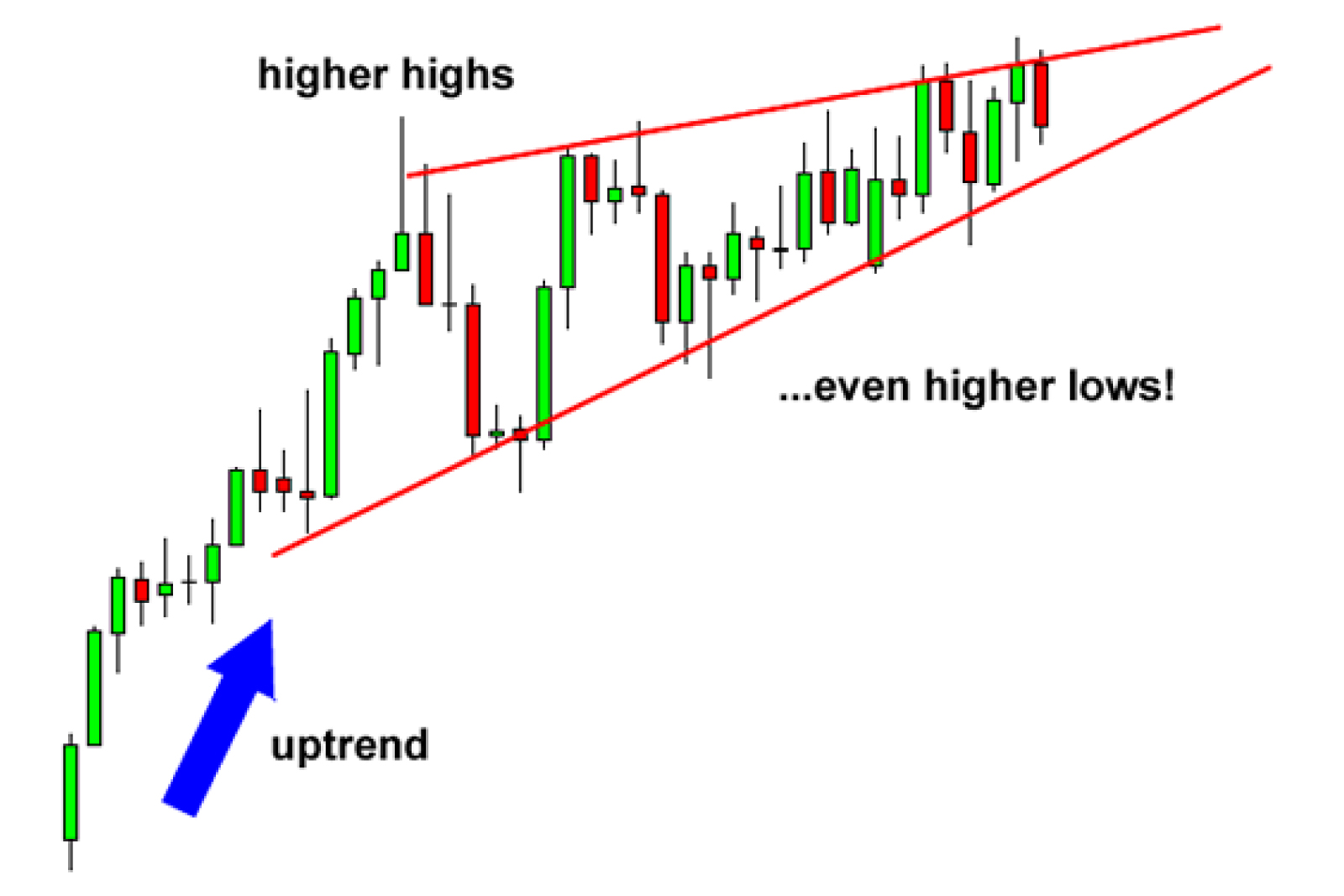

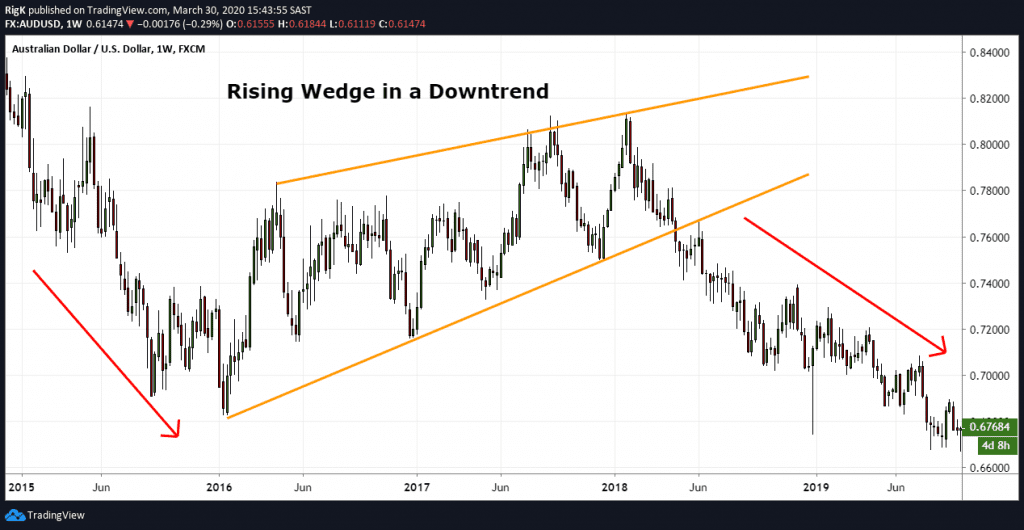

The Rising Wedge Chart Pattern Forms When There Is An Uptrend In The Underlying Stock.

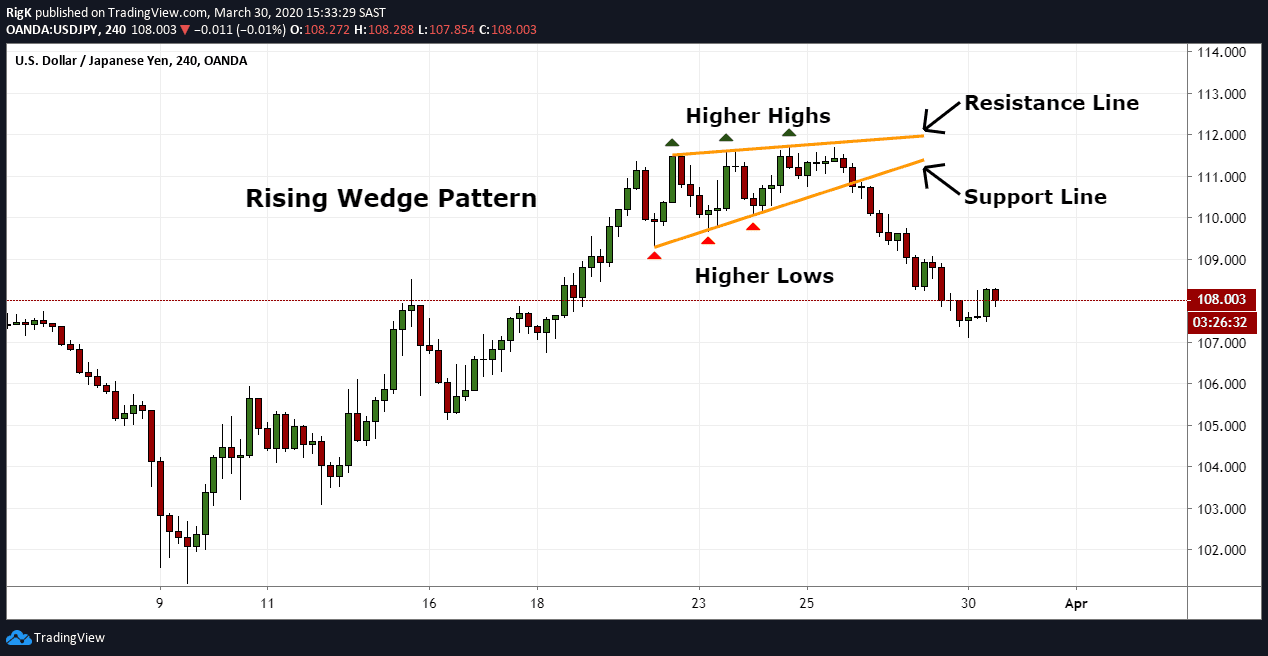

The rising wedge pattern is used in financial markets to identify potential trend reversals. A rising wedge pattern is a price chart candlestick formation that signals a bearish trend reversal. A rising wedge pattern is formed by two converging trend lines.

Rising Wedge Patterns Are Bigger Overall Patterns That Form A Big Bullish Move To The Upside.

Identifying a rising wedge pattern involves recognizing specific visual and characteristics of the rising wedge pattern on a financial price chart graph. At first, the stock seems to be going up and buyers are in. Wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods.

The Patterns May Be Considered Rising Or Falling Wedges Depending On.

Rising wedge patterns indicate the.